Studying abroad is one of the most rewarding experiences of your life as it opens doors to global opportunities, cultural learning, and personal growth. But along with the excitement comes the challenge of managing finances in a new country. Between tuition fees, rent, groceries, and weekend getaways, it’s easy to overspend if you’re not careful. That’s why smart budgeting and financial planning are essential to make the most of your international journey without breaking the bank.

How to Budget Effectively

The first step to saving money is knowing where it goes. Create a monthly budget that includes all your income sources (like family support, part-time job, or scholarships) and fixed expenses (such as rent, utilities, and tuition).

- Track your spending: Use apps like Mint to monitor your daily expenses.

- Prioritize essentials: Set limits for non-essentials like dining out or shopping.

- Set aside savings: Even saving a small amount monthly can help during emergencies or travel plans.

A well-structured budget not only helps you stay organized but also gives you peace of mind.

Common Expenses to Plan For

While living abroad, some expenses may surprise you. Being aware of them helps you prepare better:

- Accommodation: This is usually your biggest expense, so consider shared housing or university dorms.

- Food & groceries: Cooking at home saves a lot compared to eating out.

- Transport: Student travel cards or bike-sharing programs are great ways to cut costs.

- Books & supplies: Check for used books, digital versions, or university library resources.

- Leisure: Set a monthly limit for entertainment, trips, or shopping.

How to Earn as an International Student

Earning while studying can ease your financial burden and add valuable work experience:

- Part-time jobs: Cafés, retail stores, or university roles are great options within allowed work hours, usually 20 hours per week during term time (can vary).

- On-campus opportunities: Many universities offer assistantships or library jobs for international students.

- Freelancing: If your visa allows, try online freelancing in areas like writing, design, or tutoring.

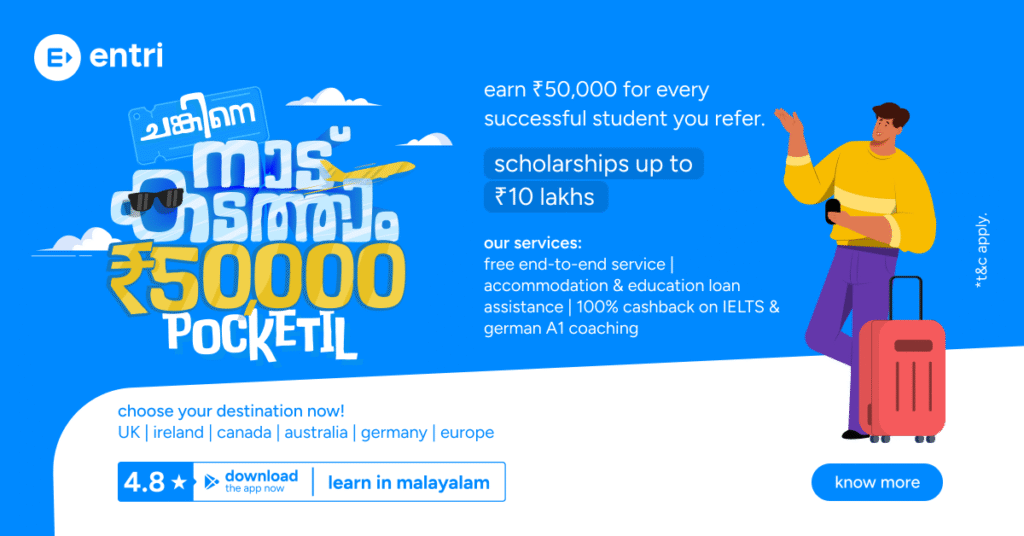

- Scholarships and bursaries: Regularly check for merit-based or need-based funding opportunities.

Why Budgeting is Important

Budgeting is about saving money, but it’s also about building financial discipline and independence. It helps you:

- Avoid financial stress and debt.

- Make informed decisions about travel, housing, and leisure.

- Develop money management skills that will benefit you for life.

Studying abroad is a once-in-a-lifetime experience, and managing your finances smartly ensures you enjoy every bit of it without unnecessary worry. With the right budgeting habits, spending awareness, and a proactive mindset, you can focus on what truly matters, which is your education, growth, and ultimately, a successful career

To know more about the cost of living in a popular study destination, check out our articles at:

Indian Students in the UK – Cost of Living and Managing Finances

Breaking Down the Cost of Studying in the USA: What International Students Should Know